Building a Robust Bond Ecosystem in Decentralized Finance

Previously, we explained the term structure of interest rates and its crucial role in laying a critical foundation for pricing derivatives in decentralized finance (DeFi). We also illustrated the role of bond markets in traditional finance (TradFi) in shaping the term structure of interest rates and the importance of establishing a liquid bond market in DeFi to achieve the same goal. That said, it is important to learn the basics of bonds. In this article, we will explore various types of bonds, the characteristics of bonds, and the components of a complete bond market.

Types of Bonds

There are many different types of bonds available to investors in TradFi: government bonds, corporate bonds, asset-backed securities, and other types of bonds. Government bonds are debt securities issued by a government to raise capital for public spending and infrastructure projects. Corporate bonds are issued by companies. Yields of corporate bonds are usually higher than those of government or municipal bonds, reflecting that these bonds carry a higher risk, while asset-backed securities are bonds that are backed by a pool of assets, such as mortgages or car loans, to provide investors with exposure to income streams generated by these underlying assets.

Characteristics of Bonds

Bonds, like other investment instruments, come with distinct characteristics that influence their performance and appeal to investors.

- Maturity date: Bonds have a specific maturity date, which is the date when the principal amount will be repaid to the investor. The maturity date can range from a few days to multiple decades.

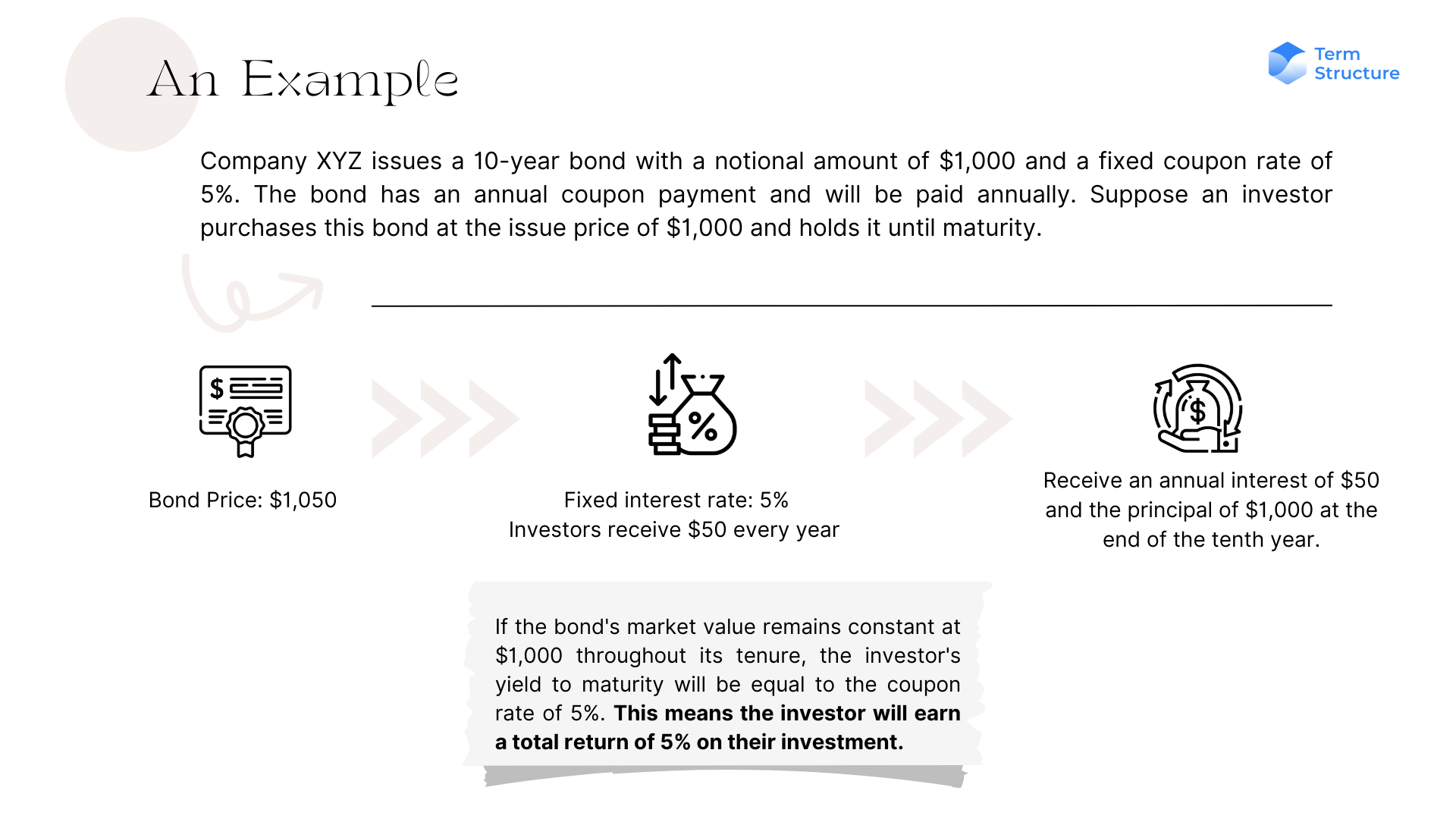

- Par value: The par value, or the notional amount, is the face value of the bond and is the amount that the issuer promises to repay the investor at maturity. For example, if a zero-coupon bond has a face value of $1,000 and a maturity date of 10 years, the bondholder will receive $1,000 from the bond issuer 10 years from the date of issue.

- Coupon rate: The coupon rate is the interest rate the issuer promises to pay on the bond. There are two types of coupon rates: fixed and variable. The interest rate is usually tied to a benchmark index, such as the federal funds rate, and is adjusted periodically to reflect changes in the index.

- Coupon dates: Coupon dates are the predetermined dates on which the issuer makes interest payments to bondholders. They can be annually, semi-annually, quarterly, or even monthly, depending on the bond's terms.

- Issue Price: The issue price is the initial price at which the bond is sold to investors when it is first issued. It may differ from the bond's face value and can be influenced by factors such as prevailing interest rates and market demand.

- Market Value: The market value of a bond refers to its current trading price in the secondary market. It fluctuates based on changes in interest rates, credit ratings, and investor demand.

- Yield to Maturity (YTM): YTM represents the total return an investor can expect to earn by holding a bond until its maturity date. It includes interest payments and any capital gain or loss relative to the bond's current market price.

What Does a Complete Bond Market Entail in DeFi?

As discussed in this article, the term structure of interest rates for USD is formed through the issuance and trading of Treasury bonds in the US government bond market. Investor activities, market expectations, and risk evaluations collectively shape the pricing and yields for different bond maturities to create the term structure of interest rates.

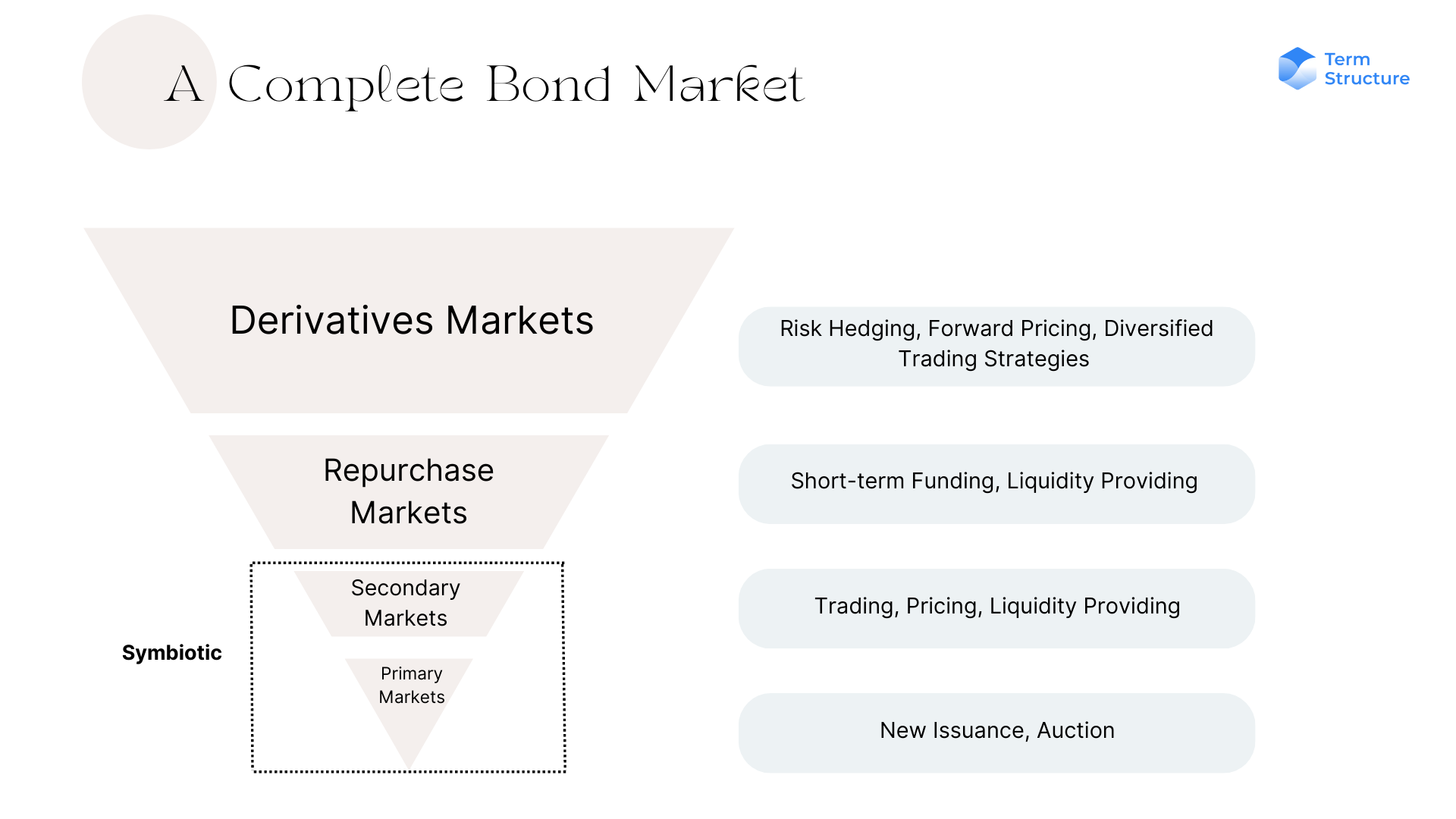

Similarly, a complete, well-developed, and liquid bond market must exist to create the term structure of interest rates in DeFi. Such a bond market should be comprised of primary, secondary, repurchase (repo) markets, and derivatives markets so that risks can be efficiently hedged and transferred among them. In particular, primary and secondary markets are symbiotic building blocks: issuers raise capital in primary markets, and investors can then trade these securities in secondary markets to enhance liquidity. At Term Structure we aim to build this missing piece of the DeFi puzzle, with an initial focus on developing primary and secondary markets. Once the bond token pool and trading volume reach a certain level, repo markets will be introduced in the next stage.

Conclusion

In conclusion, establishing a liquid and well-developed bond market is crucial for DeFi to create the term structure of interest rates. The bond market in DeFi should consist of primary, secondary, and repurchase (repo) markets so that risks can be effectively hedged and transferred. By developing a robust bond market, DeFi can lay a critical foundation for pricing derivatives and enhancing overall financial stability in the ecosystem - and Term Structure will be a critical component in enabling this.