Unleashing the Power of the Term Structure: Transforming DeFi's Pricing, Risk Management, and Investment Strategies

In the previous article, we explored the concept of the term structure of interest rates and its importance in both traditional finance (TradFi) and decentralized finance (DeFi). With that in mind, you may be curious about the importance of establishing an interest rate curve for various cryptocurrencies within DeFi. This article aims to demonstrate the crucial role played by the term structure in DeFi.

The Importance of the Term Structure of Interest Rates in DeFi

Although DeFi has been gaining traction as a revolutionary approach to traditional financial systems, there is one missing building block: term structure, or the yield curve, which indicates how interest rates vary based on the length of time until a financial instrument reaches maturity. Why is the term structure of interest rate the building block of DeFi? Recall that the term structure of interest rates in TradFi influences the pricing and valuation of various financial instruments, borrowing and lending decisions, and investment strategies. Imagine a world where the term structure of interest rate did not exist: transactions would be limited to cash transactions only because there would be no mechanism for borrowers to obtain loans or for lenders to provide funds for a specific duration. This limitation restricted the options available to individuals or businesses who might need capital for various purposes. Likewise, the term structure of interest rates for different cryptocurrencies should be in place in DeFi to allow accurate pricing, valuation, borrowing, and lending of these assets.

Impact of Term Structure on Derivatives Pricing

Furthermore, once the term structure of interest rates has been effectively established, users can anticipate the emergence of a thriving financial derivatives market. When pricing financial derivatives, such as options or futures contracts, the term structure of interest rates is critical. It influences the discounting rates used to calculate the present value of future cash flows, the anticipated cash inflows or outflows expected to be received or paid at different points in time in relation to a financial derivative contract. Changes in the term structure can cause shifts in these discounting rates. When the term structure becomes flatter (smaller differences between short-term and long-term interest rates) or steeper (larger differences between short-term and long-term interest rates), it affects market expectations of future interest rate movements. These changes in expectations can directly impact the pricing of financial derivatives. For example, a flatter term structure might indicate a belief that interest rates will remain relatively stable in the future. This can result in lower discount rates applied to future cash flows, potentially reducing the pricing of derivatives. Conversely, a steeper term structure could suggest anticipation of more significant interest rate fluctuations, leading to higher discount rates and potentially increasing the pricing of derivatives.

Derivatives: Crucial Risk Management Tools in DeFi

Why is a well-established derivatives market important in DeFi? Its significance lies in the fact that derivatives function as valuable risk management tools for individuals, businesses, and financial institutions, enabling them to effectively minimize a wide range of risks. These financial instruments derive their value from underlying assets like bonds and currencies. By taking positions in derivative contracts, market participants can protect themselves against potential price fluctuations, interest rate changes, and other risks associated with the underlying assets. This risk management technique, known as hedging, involves assuming a position opposite to an existing exposure in the underlying asset to offset or reduce potential losses from adverse price movements.

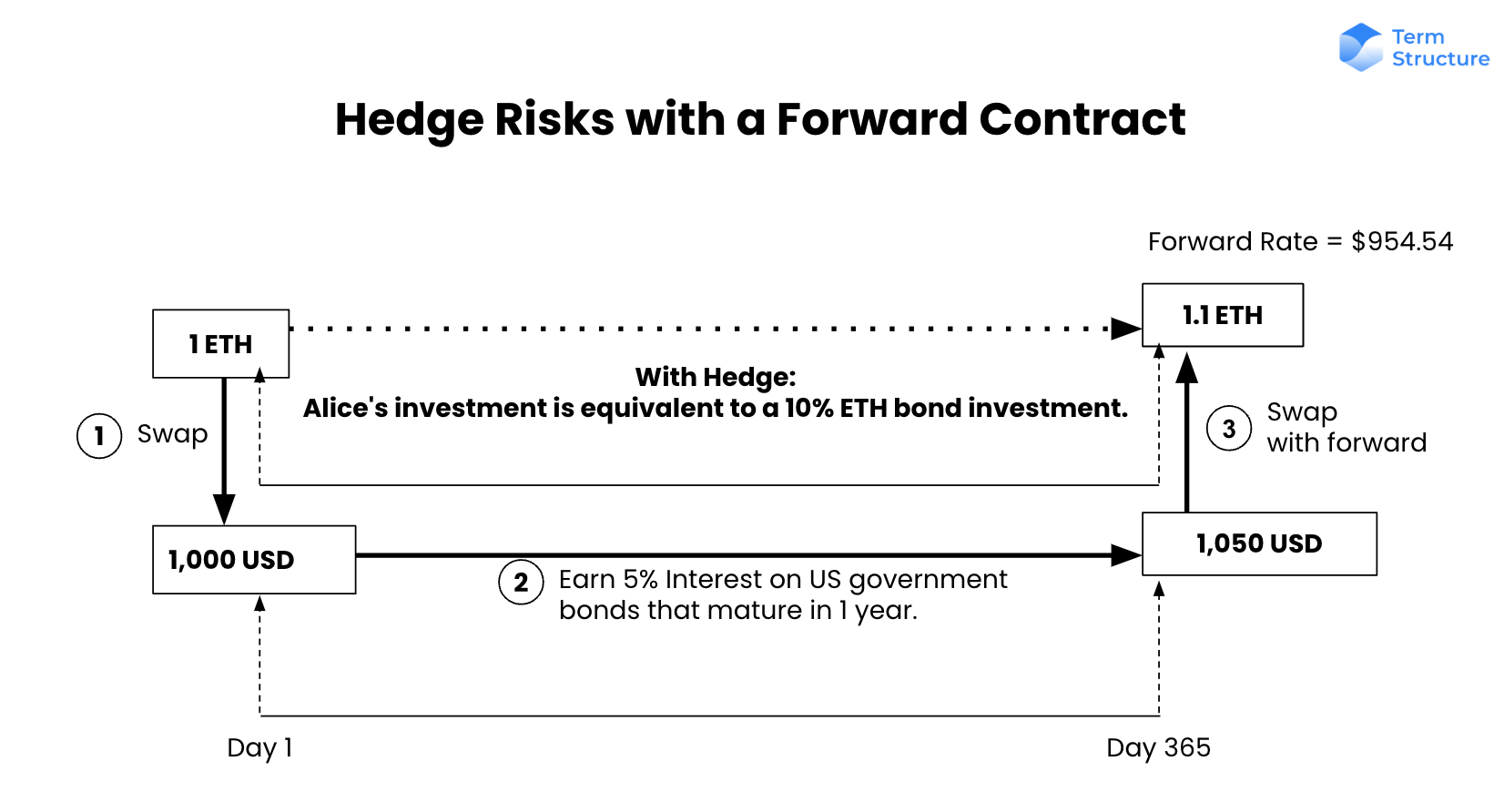

Let's break it down for better understanding. Imagine Alice has 1 ETH and wants to earn more by making low-risk investments. Instead of lending the ETH at a variable rate, she decides to swap it for $1,000, the hypothetical value of 1 ETH measured in US dollars. Then, she invests in US government bonds with a risk-free rate of 5% and a maturity date of 1 year. After 1 year, she will receive $1,050 (initial investment of $1,000 plus 5% interest). To hedge against ETH price fluctuations, Alice enters into a forward contract. (If you don’t know what a forward contract is, here is the article.) If the term structure of interest rates for a 12-month ETH bond token on the Term Structure Protocol is 10%, the forward price is around $954.54 (calculated as $1,050 divided by (1+0.1)). This ensures that Alice can use $1,050 to buy exactly 1.1 ETH one year from now despite the price fluctuations of ETH.

Now, what if Alice didn't enter into a forward contract? Suppose she swaps 1 ETH for $1,000 and invests in US government bonds with a 5% interest rate and a one-year maturity. After one year, she still earns $1,050. However, the price of 1 ETH has increased to $2,000 over the course of the year. Therefore, when Alice tries to swap $1,050 back to ETH after the bonds mature, she only receives 0.525 ETH (calculated as $1,050 divided by $2,000). This means that Alice incurs a loss of 0.575 ETH (1.1 ETH - 0.525 ETH) by not using a forward contract.

From the example above, it is evident that investors can use forward contracts to lock in specific asset prices and mitigate risks associated with price fluctuations. The term structure of interest rates plays a crucial role in determining forward contract prices and various financial derivatives. Therefore, establishing a transparent, effective, and reliable term structure of interest rates is vital for the long-term development of DeFi.

Conclusion

In conclusion, the term structure of interest rates plays a vital role in DeFi by providing reliable pricing mechanisms, effective risk management tools, and opportunities for diverse investment strategies. As the market continues to evolve, the term structure of interest rates will become a building block for DeFi and empower individuals and institutions to confidently navigate the world of cryptocurrencies.