Riding the Wave of Stability: Why Fixed Interest Rates are the New Cool in DeFi

Decentralized Finance (DeFi) is transforming traditional finance by providing open and accessible financial solutions built on blockchain technology. A key part of this ecosystem is DeFi lending protocols that offer an alternative to traditional lending financial services. These protocols operate without the need for intermediaries, such as banks or financial institutions. Instead, DeFi lending platforms use smart contracts to automate lending and borrowing activities and ensure that loans are overcollateralized to reduce the risk of default.

Lending protocols in the market typically provide variable interest rates, fixed interest rates, or a combination of both. Most dominant players in the field use variable interest rates to facilitate trading. They commonly use automated market makers (AMMs) for trading and peer-to-pool (p2pool) for matching borrowers with lenders. However, fixed interest rates have increasingly played a crucial role in attracting institutional investors to DeFi and ensuring its sustainable growth. A fixed interest rate refers to an interest rate that remains constant throughout the entire duration of a loan or investment. Since institutional investors prioritize stability and predictability when allocating their funds, fixed interest rates provide the necessary assurance for capital preservation and predictable returns. Incorporating institutions into the DeFi ecosystem is vital for driving mass adoption of DeFi.

In this article, we will compare various lending protocols and explain why fixed-rate and peer-to-peer (p2p) mechanisms are more suitable than AMM and p2pool for the long-term development of DeFi.

Floating-rate Lending Protocols in DeFi

The two major floating-rate lending protocols have a substantial market share and high TVL. Both use AMM to determine the interest rates of tokens and p2pool to match borrowers with lenders. These AMMs use liquidity pools (hence the word “p2pool”) that allow users to deposit funds for borrowing and lending. The interest rates of tokens are influenced by the utilization rate, the ratio of borrowed tokens to deposited tokens in the liquidity pool. Thus, the utilization rate is a significant factor influencing the functionality of AMM and its ability to determine interest rates.

However, this approach has a drawback when it comes to interest rate products: there is almost always a spread between lending APR and borrowing APR because borrowers and lenders are not matched peer-to-peer. Although the p2pool mechanism provides sufficient exit liquidity for lenders to withdraw, it reduces the efficiency of deposited funds and presents funding-cost risks for borrowers.

An Alternative - Building on Existing Protocols

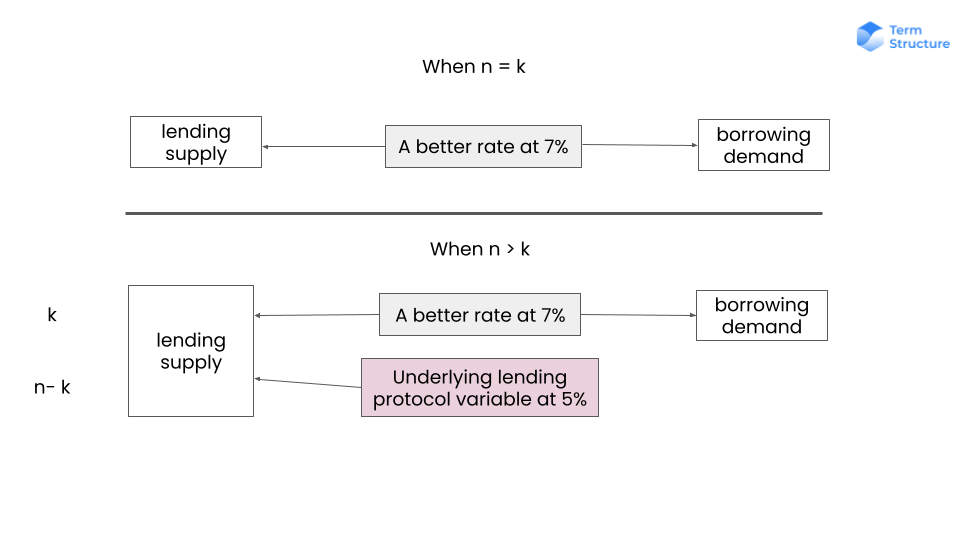

Some protocols recognized the problem of using AMM and p2pool. As a result, they leveraged the huge user base and lending rates of the major lending protocols to create a peer-to-peer pricing mechanism. Yet, it cannot fully meet supply and demand since there will always be cases in the market where the number of depositors, n, exceeds the number of borrowers, k (or vice versa). In these instances, the matching engine will select k depositors to receive P2P APY, while the remaining (n-k) depositors continue to receive the original interest rates in the underlying lending pool.

This approach might seem novel at first; however, depositors who are not matched with borrowers must settle for variable interest rates. That said, funds deposited in the liquidity pool are not effectively used because there will be idle or underutilized capital in the pool. This results in potentially lower returns for liquidity providers.

An illustration of how such protocols work

Yield Redistribution

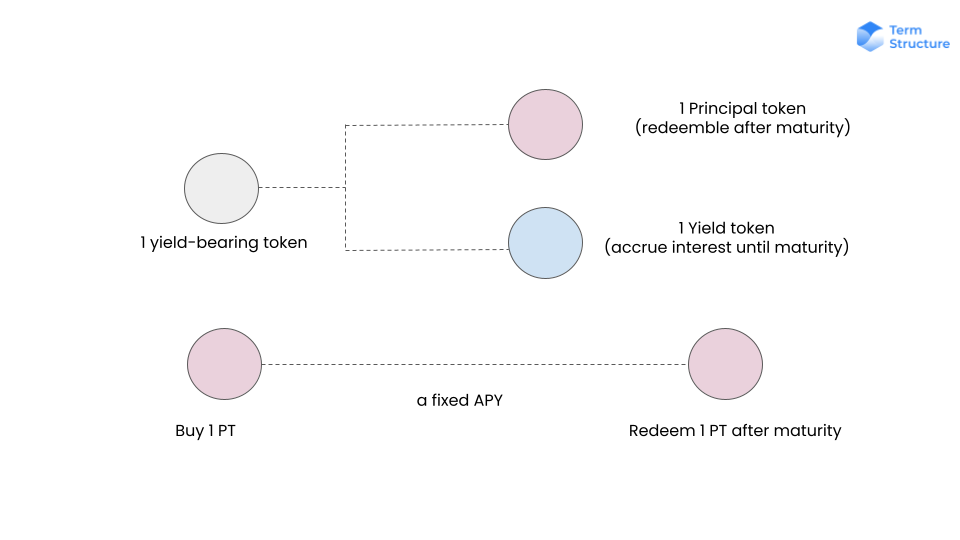

Some DeFi lending protocols aim to create fixed-rate by splitting yield-bearing tokens into principal tokens (PT) and yield tokens (YT). Principal tokens allow holders to receive a fixed quantity of an underlying token on a specified date. In this way, fixed interest rates for the underlying tokens are created. Similarly, users can either sell or buy YT tokens to secure profits based on their prediction of the market movement.

However, the interest rates of these PT tokens are not determined by market consensus. This means that users have no choice but to accept or reject the rates offered because the pricing for PT and YT tokens is based on AMM pricing, which is subject to fluctuations in pool supply. Price volatility can make it challenging for users to accurately predict and execute trades. This can introduce risks and prevent institutions from entering the DeFi space.

Splitting a yield-bearing token into a principle token and yield token.

Conclusion

In summary, we discussed the advantages of fixed interest rates and the limitations of AMM and p2pool mechanisms. While these models improve liquidity, they fail to provide stability and predictability to align with the needs and risk management strategies of institutional investors. The growth of DeFi can be accelerated with a transition to fixed interest rates to attract institutional investors.