Unraveling Term Structure - The Building Block of DeFi

In previous articles, we went to great lengths to introduce the Term Structure protocol and its solutions for laying a solid foundation for the decentralized finance (DeFi) ecosystem. However, you may still be wondering: what exactly is term structure? While you might have seen this term multiple times online, its direct connection to DeFi might not be entirely clear. This article seeks to clarify the concept of term structure and its role in both traditional finance (TradFi) and DeFi.

What is the Term Structure of Interest Rate?

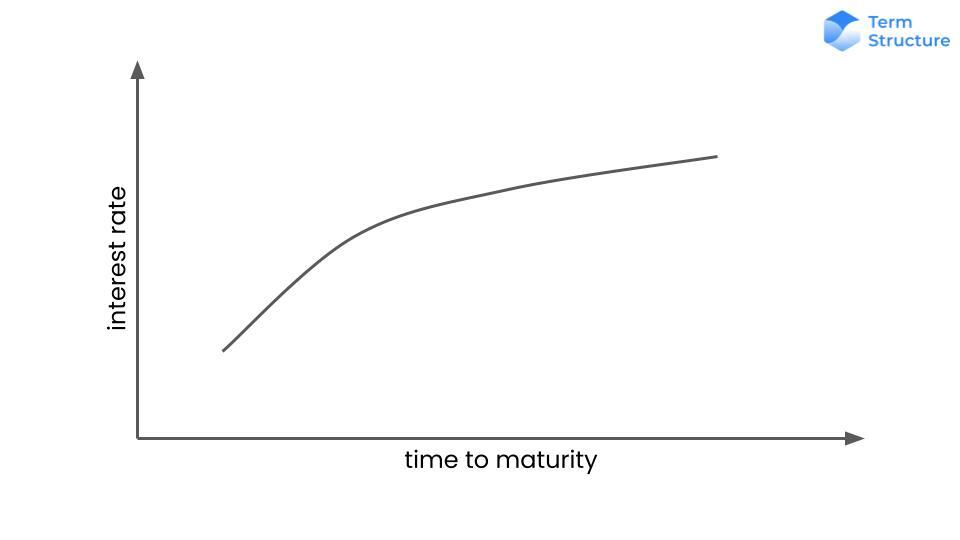

The term structure of interest rate, or the yield curve, refers to the relationship between the interest rates on financial instruments, such as bonds or loans, and their respective maturities. Put simply, it indicates how interest rates vary based on the length of time until a financial instrument reaches maturity. The term structure of interest rates provides the economic outlook of a specific economy in the real world. It also represents the market's predictions for future interest rates by considering factors such as perceived risk and supply and demand dynamics.

Imagine you are looking to borrow money to purchase a home. The interest rate on your mortgage loan will be influenced by the term, or length of time, until the loan matures. If you opt for a shorter-term loan, say 5 years, the interest rate might be lower than a longer-term loan, such as 30 years. This difference in interest rates based on loan duration exemplifies the term structure.

The Role of Term Structure

The term structure of interest rates plays a pivotal role in financial markets by providing valuable information about market expectations and influencing investment decisions.

- Pricing and Valuation: Term structure influences the pricing and valuation of various financial instruments. Generally, bonds with longer maturity provide higher interest rates to compensate investors for the increased risk arising from extended duration. This interplay between interest rates and maturities affects the pricing and yields of bonds and loans.

- Borrowing and Lending: The term structure impacts the borrowing and lending decisions of individuals, businesses, and governments. When short-term interest rates are higher than long-term rates, it may be advantageous for borrowers to secure long-term loans before rates rise. Conversely, lenders may prefer shorter-term lending during a downward-sloping yield curve.

- Investment Strategies: Investors analyze the term structure to formulate investment strategies. One approach involves "yield curve positioning," where investors adjust their portfolios based on the current shape and expected changes in the yield curve. Understanding the term structure aids investors in assessing risk and efficiently allocating their capital.

Is There Term Structure in DeFi?

The term structure of interest rates plays a crucial role in TradFi; however, there is currently a lack of effective bond protocols to establish the term structure in DeFi. In the US treasury bond market, the term structure of interest rates is created through the issuance and trading of Treasury bonds. The combination of investors’ buying and selling activities, market expectations, and risk evaluations influences the pricing and yields associated with these bonds. These actions collectively shape the yields for different bond maturities to ultimately create the term structure of interest rates.

Creating a liquid bond market is the first step for laying the crucial groundwork necessary to develop the term structure of interest rates. The Term Structure Protocol was built precisely for this purpose. By developing Primary Markets with hourly auctions and Secondary and Repurchase Markets with real-time order books, this protocol aims to ultimately establish interest rate benchmarks, the DeFi equivalent of the US treasury yield curve, for major cryptocurrencies.

Conclusion

In conclusion, the term structure of interest rates plays an important role in TradFi and constitutes an essential component of the DeFi ecosystem. By filling the gap and laying the critical foundation, the Term Structure Protocol positively contributes to the growth of DeFi. As the protocol evolves, it has the potential to unlock new opportunities, improve risk management strategies, and promote the growth and acceptance of decentralized finance as a major participant in the broader economic environment.