Referral Programs in DeFi: Analyzing Effectiveness and Strategies for Success

A referral program is a word-of-mouth marketing strategy that incentivizes customers to refer friends, family members, or connections to use a financial product or service. It is a popular, low-cost marketing strategy used in the financial industry and banks to promote business, raise brand recognition, and build customer loyalty. This strategy is also common in the world of decentralized finance (DeFi). Many protocols implement rewards programs with the aim of increasing awareness, attracting active users, and fostering community growth. This article will explore the referral programs of Lido Finance and Perpetual Protocol, analyze their effectiveness, and offer recommendations to harness the potential of such marketing campaigns.

Case Study 1: Lido Finance

Lido Finance (Lido) is a non-custodial staking protocol that enables users to stake their Ethereum (ETH) tokens and receive tokenized representations called liquid stETH tokens. These tokenized assets provide users with liquidity while still allowing them to earn staking rewards on Ethereum.

The Lido Referral Program was launched in July 2021 as a marketing effort to increase the number of active stakers, promote the benefits of stETH, and boost Lido's total value locked (TVL). To participate, users simply need to generate a referral URL from their Ethereum addresses and share the link with others. The referrer is rewarded with payback in LDO, Lido's native token, based on the amount of ETH staked by users who join through the referral link.

The Effectiveness Falls Below Expectation

Lido’s referral program was recently discontinued due to its failure to increase the amount of staked crypto assets on the protocol. Unsurprisingly, the program was frequently abused by individuals who exploited the referral rewards. This misuse involved cycling staking in which users repeatedly generated rewards by using the same amount of ETH and referring to their own addresses. For instance, some users took advantage of incentivized liquidity pools, such as the Curve ETH:stETH pool, to sell their rewards (stETH) for more ETH and repeat the process several times. Such actions undermined the development of the protocols' ecosystems and, even worse, directly and indirectly affected the ETH:stETH peg.

After implementing the referral program, Lido saw a surge in suspicious abuse cases, reaching 60% by the third reward payout period. Although Lido's referral program resulted in over 100% growth in unique addresses, it can be impossible to track token flow, potentially allowing abuse cases to receive rewards. By the time the proposal was made to switch the referral program to whitelist mode, around 30% of the initially allocated referral rewards pool had already been paid out to referrers (4.7M LDO out of 15M LDO).

Case Study 2: Perpetual Protocol

Perpetual Protocol is a DeFi protocol that enables users to trade perpetual futures, specifically perpetual contracts of crypto assets. In addition to trading, there is market making, where makers stake PERP (the native cryptocurrency of Perpetual Protocol) to provide liquidity to the perpetual futures exchange. Liquidity providers earn trading fees whenever traders transact against assets in the liquidity pool.

Perpetual Protocol's referral program was launched to accelerate the growth of active stakers and traders by incentivizing existing users. Makers are rewarded with PERP based on the percentage of referred volume (people trading on Perp using a partner's referral code) and the percentage of vePERP staked relative to the total referred volume and total staked vePERP. Meanwhile, referred traders earn a 5% rebate on their trading volume by using a referral code.

The Result Was Also Unsatisfactory

To evaluate the effectiveness of Perp's referral program, we collected data from mid-December 2021 until the present. We identified every referral code that was created, along with the number of times it was used and when it was used. We assumed a referral code used within a 10-minute window after its creation was suspicious because it could be self-referring. Through the analysis, we discovered that out of the 488 referral codes created and used since December 2021, 22.8% of them were potentially created and used by susceptible stakers/addresses. We believe that the figure underestimates the actual number of abuse cases due to the potentially restrictive nature of the 10-minute window condition. Furthermore, this percentage of suspicious referral codes does not directly correspond to the percentage of rewards pool paid out to actual cycle staking users.

Strategies to Enhance the Effectiveness of Referral Programs

Although referral programs can lead to misuse, they have contributed to Total Value Locked (TVL) growth. For instance, during the third payout period of Lido's referral program, there was a 50% increase in the total staked amount. Specifically, on July 19, 2021, 633K ETH was staked, with 314K ETH staked through the referral program. This shows that referral programs can be a powerful tool if implemented wisely. In fact, various strategies can be employed to mitigate instances of misuse and abuse.

Whitelist Mode

In late 2021, Lido updated its referral program to whitelist mode: only addresses/users approved by the Lido DAO could participate. This selective process filtered potential self-referrers and could improve the security and productivity of the program. Yet, this approach presented a challenge in terms of on-chain data privacy because it required each address to undergo KYC verification. While this method can be integrated with influencer marketing, adopting such an approach may impose restrictions by limiting participation and potentially undermining the primary advantage of this word-of-mouth marketing strategy.

Stake and Refer

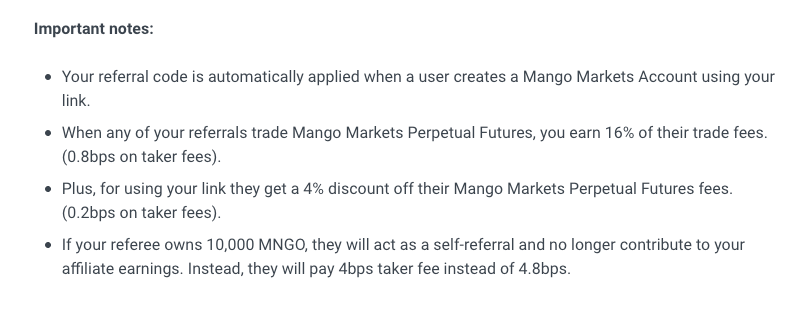

An alternative approach is requiring users to stake tokens as a referrer. For example, the Mango Market's referrals and affiliate program incentivizes referrers by granting them a percentage of the trade fees incurred by their referees, while referees benefit from discounted fees on Mango Market Perpetual Futures. And to be eligible for the discount, the referees must buy and hold tokens. However, if the referees hold over a certain amount of tokens, the referrers will no longer receive affiliate earnings. This creates interesting dynamics where

- real users will likely buy and hold tokens and hence increase the demand for ,

- referrers are forced to acquire new referees to maintain their affiliate earnings, and

- self-refer users can't double dip, meaning you either choose lower transaction fees or affiliate fees.

However, each marketing strategy has its limitations and associated risks, and referral programs are no exception. In cases where there is no effective way to mitigate the risk of self-referring, marketers must be prepared to treat referral programs as a marketing expense.

Conclusion

In conclusion, referral programs have become popular marketing strategies in DeFi, but challenges like misuse and abuse can hinder their effectiveness. Case studies of Lido Finance and Perpetual Protocol highlight the complexities involved. Strategies such as whitelist modes and transaction fee discounts can enhance referral programs’ effectiveness, but they come with their limitations and risks. Marketers must carefully evaluate and adapt their approaches to mitigate these risks and ensure long-term success. With the right measures in place, referral programs can continue to be valuable tools for driving growth, brand recognition, and customer loyalty in DeFi.