Recap of the Term Structure’s Testnet Trading Competition

The Term Structure Testnet Trading Competition, held from March 4 to March 10, 2024, offered participants a unique opportunity to test their trading skills in a simulated market with dynamic yield curves and interest rates.

This article explains the procedures to claim the prizes, highlights critical metrics during the game, and what to look forward to in the following.

Procedures to Claim Prizes

- For the top 10 participants with the highest balances, we’ve sent the prizes in USDC to your wallet address on Poylgon. Here is the address where we sent the funds.

- Every participant can claim their NFT for this competition here.

Critical Metrics

General

Overall, we have 523 participants in this game. Unsurprisingly, most of them joined on the first day of the competition.

Primary Markets

Our participants have placed 10,316 orders on the primary markets, where hourly batched auctions match orders from borrowers and lenders. Among 10,316 submitted orders, 5402 are matched with loan values of around 226 billion USD, albeit not real money. Yes, billion with a b.

We only charge fees once an order is matched, lenders and borrowers alike. You can learn more about how we charge fees here.

Secondary Markets

Now, let’s move on to secondary markets, where we use order books to match orders from buyers and sellers of the tTokens.

During the seven-day game, we generated USD 5,130,139,420,645 worth of trading volume. Among all the markets, tTokens with wBTC as the underlying asset generated the highest trading volume—a whopping 95% of which was precious.

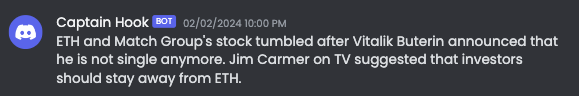

The Impact of News on Token Prices

News significantly sways market prices and interest rates in our trading contest. The following are some sequences of news that significantly impact this virtual economy.

Stablecoin Depegged Due to Bank Runs

- a massive bank run happened at bank TWC due to the huge unrealized loss in derivatives trades. TWC is a famous crypto friendly bank.

- Federal Reserve already shut down the daily operation of the TWC bank after the bank runs triggered.

- The leading stablecoin issuer Circus claimed their 5% of USD reserve in the TWC bank.

- The CEO of Bank TWC said no need to worry about the deposit.They are all secured.

- Federal Reserve launched a standard funding facility for troubled banks like TWC.

- Federal Reserve and FDIC are working together to find the new buyer for TWC bank

- TWC bank reopened after the new buyer got in.

An institution BTC Whale in Financial Crisis.

- The leading business intelligence company MacroStrategy is in a financial crisis because it is delaying paying the interest of their corporation bond next quarter.

- Financial experts said MacroStrategy funded too much capital buying Bitcoin.

- One famous investor said he would help MacroStrategy with new capital increasing in case MacroStrategy stopping buying more Bitcoin and focusing on their business intelligence products.

- The funder of MacroStrategy said he is thinking about selling Bitcoins and buying the AI computation power to develop business intelligence products for the next generation.

- MacroStrategy is seeking a big buyer for their Bitcoin.

- Crypto expert said Bitcoin price will go down more than 50% if the Bitcoin selling deal come true.

- Several Bitcoin spot ETF are facing redemption because of the MacroStrategy Bitcoin selling deal.

- El Salvador may buy the 50% Bitcoin holding of MacroStrategy if they issue the volcano bond successfully.

- MacroStrategy finds new investors to fund the company without selling any Bitcoin.

What’s Next

We’ve started fixing bugs found during the competition and implementing the suggestions proposed by community members. Once done, we will launch our mainnet soon.

In the meantime, you can:

- Head to Zealy to complete tasks and earn points: https://zealy.io/c/termstructure/questboard

- Follow us on Twitter, Discord, Telegram, and Linkedin.