How to Trade Fixed-Income Tokens on Term Structure?

Most people are familiar with buying and selling tokens. However, at Term Structure, the assets bought and sold are not cryptos but fixed-income tokens derived from crypto. As a result, users must navigate the dual challenges of interest rate fluctuations and price changes. This adds complexity to their trading strategies.

This article covers portfolio management, profit and loss in fixed-income token trading, the dynamics of lending as buying and borrowing as shorting fixed-income tokens, the specifics of stablecoin-based fixed-income token trading, and the factors influencing profit and loss on borrowing.

Let's dive in!

Portfolio Management

If you are unsure about the future price movements of certain tokens, diversifying your investments can be a wise strategy. Including a specific proportion of stablecoins in your portfolio enables you to balance risks and returns, offering a fundamental and efficient strategy for investment management.

For example, in a bull market, investors can allocate 80% of their portfolio to non-stablecoins to benefit from rising crypto prices. When unsure about BTC or ETH's performance, a strategy could be to hold both equally, with each representing 40% of the portfolio.

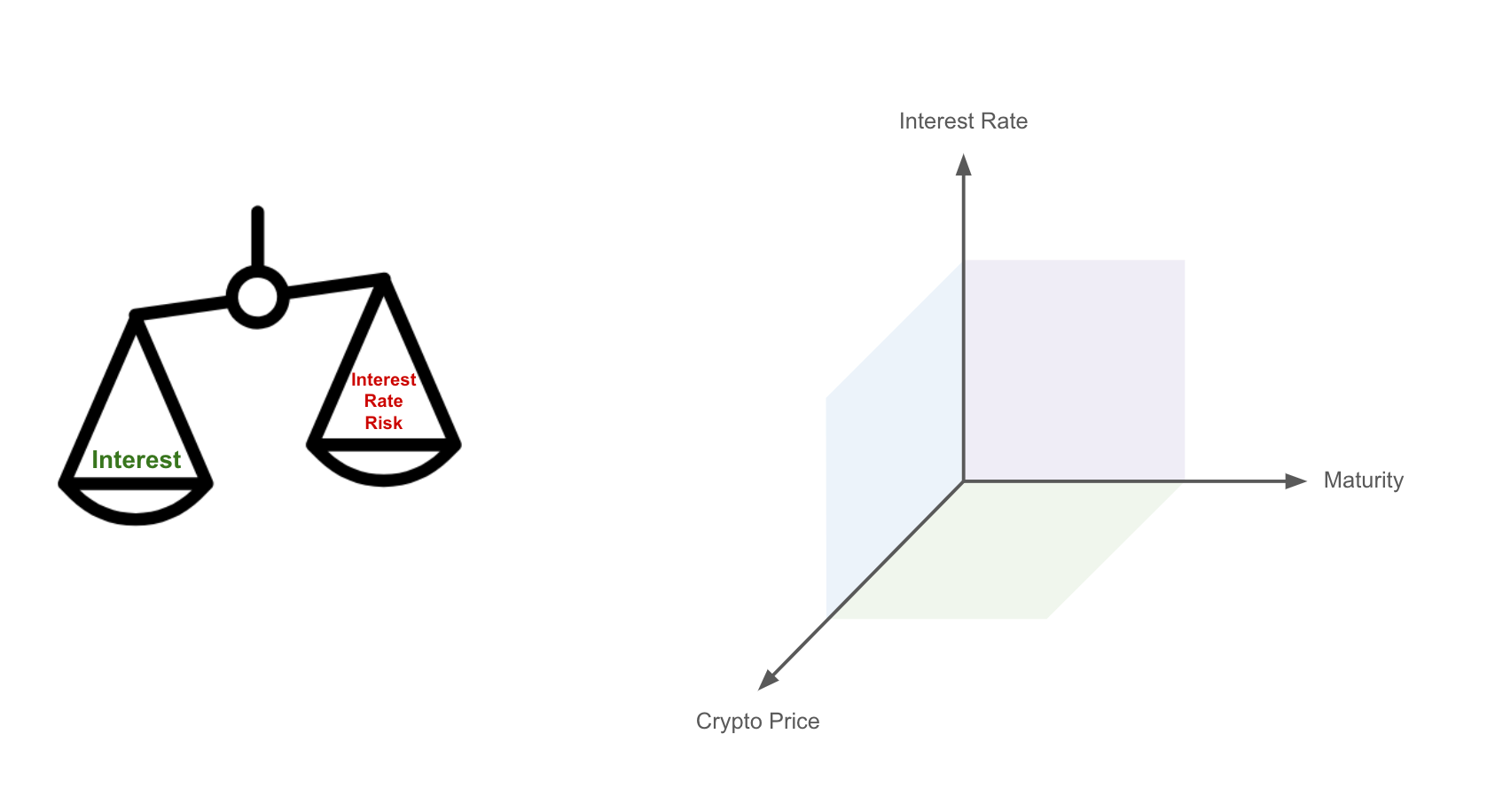

Simply holding cryptocurrencies does not generate interest income. However, if investors use their crypto to buy fixed-income tokens, they can earn interest income. The trade-off for this interest income is taking on the risk of interest rate changes that come with fixed-income tokens. Investors confident in predicting future interest rate trends may benefit from selecting fixed-income tokens with longer maturities, which typically offer higher interest returns. By contrast, for those uncertain about future interest rate movements, it is prudent to opt for fixed-income tokens with shorter maturities. While these provide lower interest returns, they also carry reduced interest rate risk.

Fixed-Income Token Trading

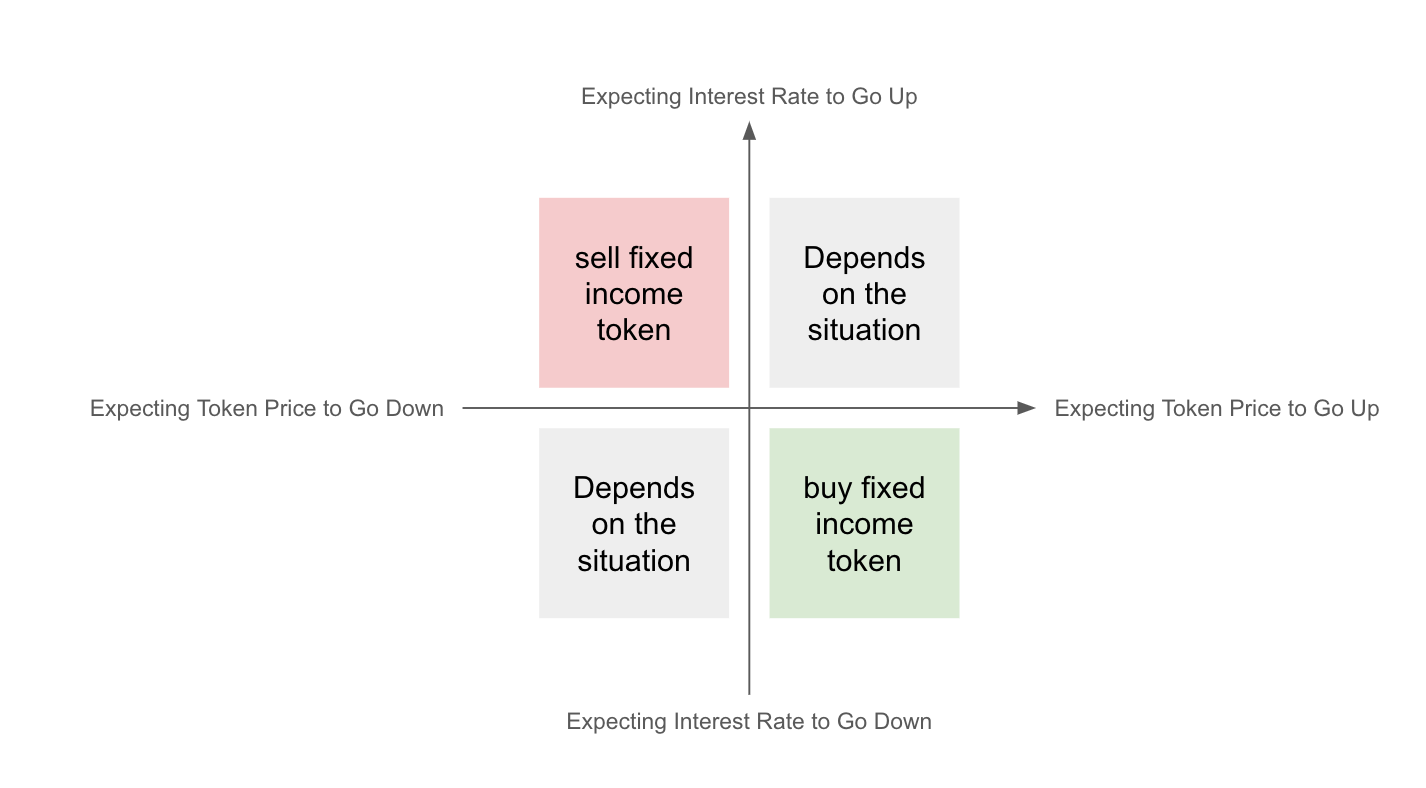

The profit and loss of fixed-income tokens depend on changes in two dimensions: token price and the interest rate.

The below examples illustrate different trading strategies for tWBTC-12m based on anticipated movements in interest rates and WBTC prices. The focus is on evaluating overall profit and loss and considering the interplay between interest rate fluctuations and price movements under different market scenarios.

- Buy when you expect the interest rate of tWBTC-12m to fall and the price of WBTC to rise.

- Sell when you expect the interest rate of tWBTC-12m to rise and the price of WBTC to fall.

- When you expect both the interest rate of tWBTC-12m to rise and the price of WBTC to rise, consider the overall profit and loss from interest rate losses and price gains.

- When you expect the interest rate of tWBTC-12m to fall and the price of WBTC to fall, consider the overall profit and loss from interest rate gains and price losses.

Lending as Buying and Borrowing as Shorting Fixed-Income Tokens

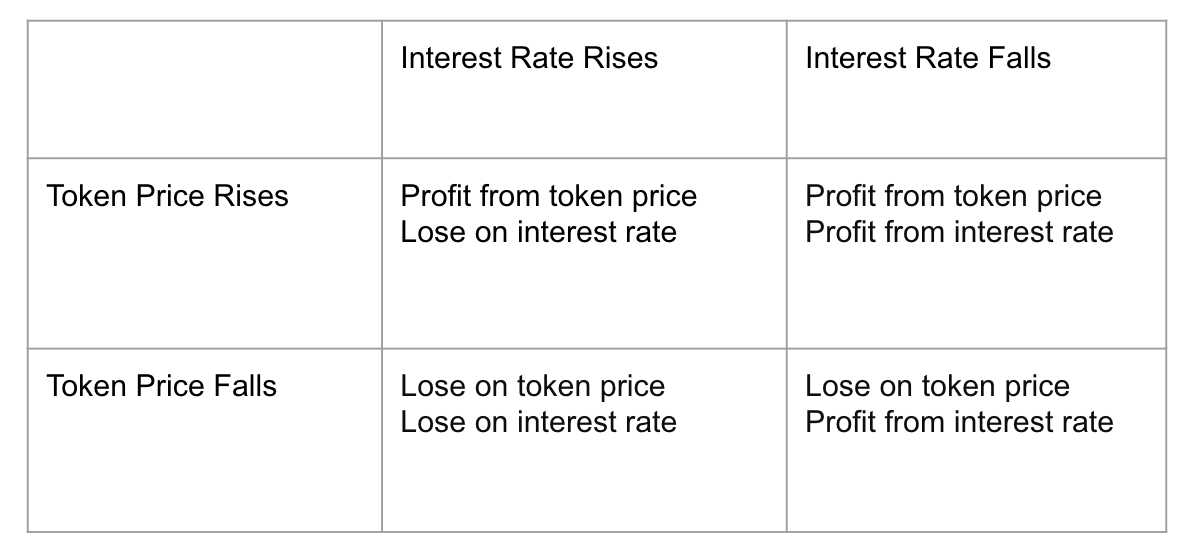

Whether serving as a Lender in the Primary Market or a Buyer in the Secondary Market, one faces the potential gains and losses stemming from fluctuations in fixed-income token interest rates and the volatility of lending token prices.

Borrowers, acting as the counterparts to Lenders, are positioned opposite to Lenders in terms of interest rate and price fluctuations. If a Lender profits from interest rates and token prices, it means the borrower incurs losses in these areas, and vice versa.

Trading Stablecoin-Based Fixed-Income Tokens

Due to their inherent stability, stablecoins typically experience minimal price fluctuations, which can often be negligible. In stablecoin-based fixed-income tokens trading, it is usually only necessary to monitor changes in interest rates that could affect profit and loss.

Occasionally, stablecoins might deviate from their intended peg. If there is an expectation that a stablecoin's price will continue to fall, one strategy could be to borrow the decoupled stablecoin through the Primary Market and sell it. Then, when the stablecoin's price reaches a relative low, you can buy it back to repay the debt and profit from the price difference. However, it is important to consider whether the interest costs incurred from borrowing the stablecoin might outweigh the profits made from the price differential.

Factors that Influence Profit and Loss on Borrowing

Borrowers are required to provide collateral to obtain loans in the Primary Market, typically using a different type of token than what they are borrowing. This collateral guarantees the borrower's repayment. If the loan is not repaid upon maturity or if the collateral's market value falls to the liquidation threshold, the Term Structure Protocol will liquidate the collateral to repay the debt.

For borrowers, an increase in the price of the collateral works in their favor because this makes the loan less likely to be liquidated. Similarly, a significant drop in the price of the borrowed token benefits the borrower, who can profit from the price difference by selling the borrowed tokens immediately and then buying them back at a lower price to repay the loan.

An increase in the interest rate of the borrowed token after the borrower has taken out the loan is also advantageous because it means the borrower has secured the loan at a relatively lower interest rate. Additionally, a decrease in the interest rate of the collateral currency benefits the borrower, especially if the collateral token could have been lent out to earn interest.

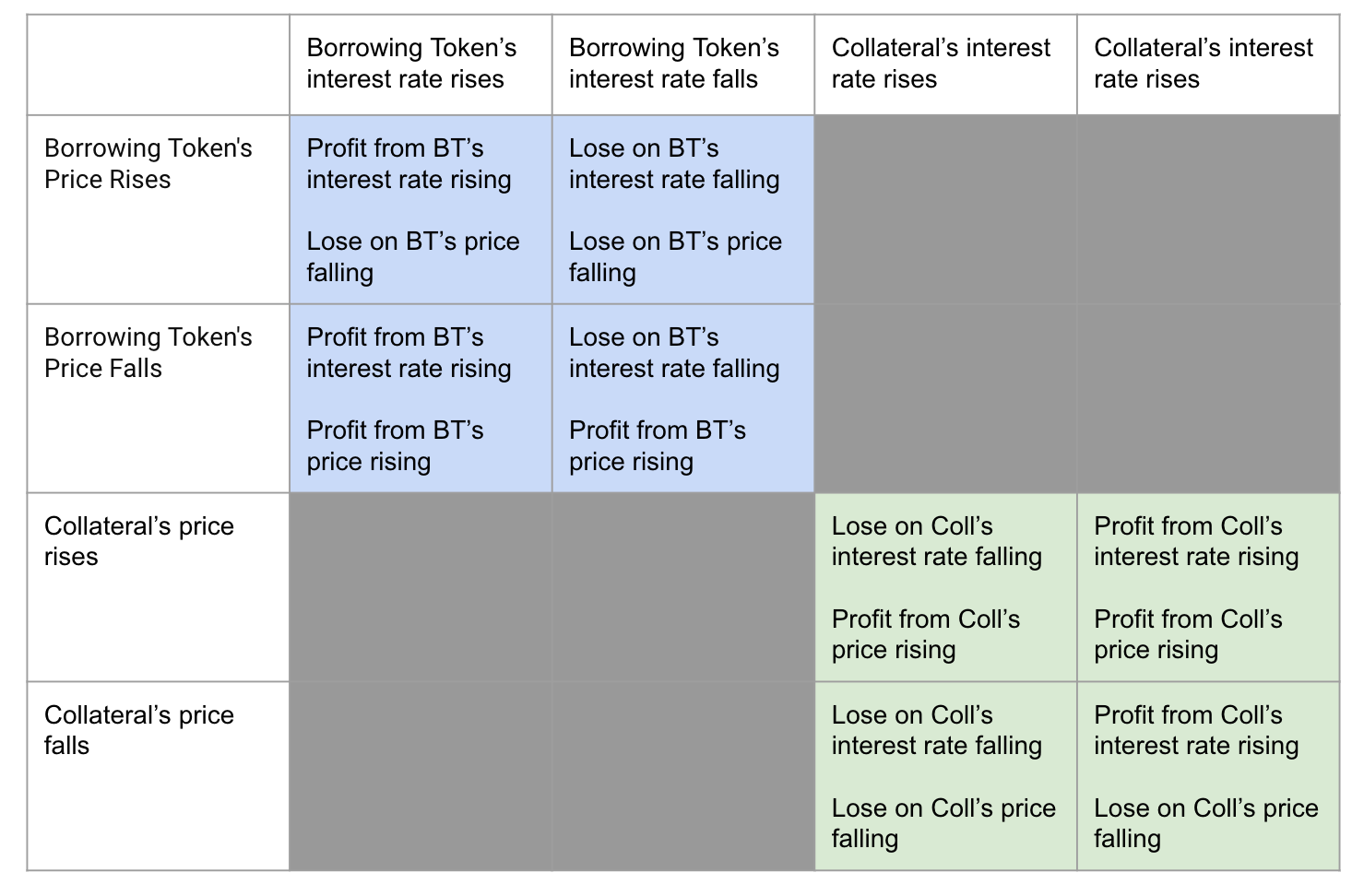

Let's look at an example below. To calculate the overall outcome (win or lose) in this scenario, select one square from each of the four blue and four green squares.

BT and Coll. represent a borrowed token and collateral, respectively.

This example shows that when a person borrows a token, there are two key speculations. First, he speculates on the interest rate of the borrowed token (BT) increasing and its price decreasing. Second, he also anticipates the interest rate of the collateral (Coll.) decreasing and its price increasing.

Conclusion

Based on the essential strategies outlined across four main areas, it is evident that numerous factors influence ultimate trading performance in the fixed-income markets. Traders must exercise caution, leverage their business acumen, and analyze market news to implement effective strategies. You are also welcome to visit the Term Structure Academy to navigate complex financial terms and jargon.